Medicare & Medicare Supplements

Medicare & Medicare Supplements

Supplement Your Medicare Coverage with Help from Income for Life

Typically, when you hit 65, you become eligible to enroll in Medicare. This can be a very beneficial government program for many, especially as you enter your retirement years when work will no longer cover your health insurance. But navigating Medicare and understanding your coverage is not always easy. In fact, it can be exceptionally difficult to figure out what plan options you need to enroll in now in order to have effective and affordable coverage later down the road.

Understanding Medicare

All American citizens are eligible for Medicare Part A. This part of Medicare coverage is free because you spent your working years paying taxes into the government program. However, Part A for Medicare is limited in its coverage. In general, it helps to cover:

- Inpatient Hospital Care

- Inpatient Nursing Care

- Hospice Care

- Home Health Care

For example, if you were to have a slip and fall, and you had Medicare Part A coverage, your trip to the hospital would be mostly covered. You would have to pay a deductible of some kind and potentially other miscellaneous expenses from coinsurance. However, if you were to need follow up outpatient appointments or long-term care after this slip and fall, that would not be covered under Medicare Part A.

Medicare Part B is an elective addition to your Medicare coverage, and requires both enrollment and a monthly premium, much like regular health insurance. However, you gain a lot by adding Medicare Part B to your coverage, including:

- Medically Necessary Doctors’ Services

- Outpatient Care

- Home Health Services

- Doctor Prescribed Medical Equipment

- Preventative Health Services

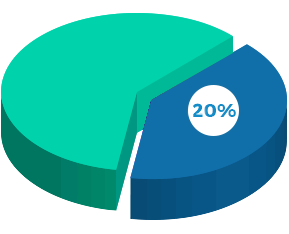

While you’ll still be required to pay a 20 percent coinsurance, your deductible will be substantially lower and you’ll have access to many more health services.

In addition to Medicare Parts A and B, there are additional plans and supplements you can purchase in order to better control your out-of-pocket medical expenses. These options can include Part D, which is prescription drug coverage, and Part F, which provides you with complete medical coverage with zero out-of-pocket expenses. All of these plans and supplements are standardized by the national government, however, you can shop for the best price from the best private provider for these additions. Income for Life has access to all of your options, no matter where you live, in order to help you best plan for your finances during your retirement years. Let Income for Life help you protect your retirement income with the right Medicare options and supplements for your future needs.

“The Treasury and the IRS are announcing steps that will ease regulatory barriers in the market for annuities and other forms of lifetime income.” Source: Alan Krueger, Council of Economic Advisors, WhiteHouse.gov. Feb 2012.)

Medicare Supplement Coverage

While Medicare Part A will cover many hospital and hospice expenses, it doesn’t cover much else. Even with Part B coverage, in 2012 roughly 20 percent of a senior’s income was spent on additional out-of-pocket medical costs. When you retire, can you afford to pay for that?

Attained Age Versus Issued Age

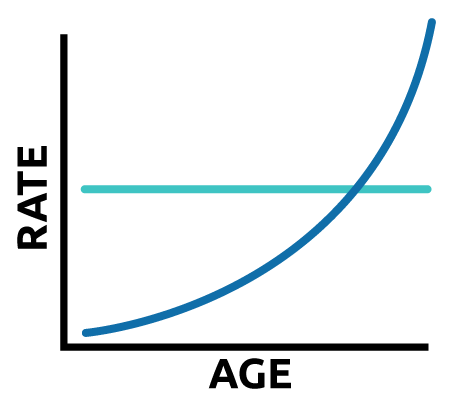

Getting the best prices on your Medicare supplements is exceptionally important, and understanding the factors that affect these prices can often be tricky. But one factor can greatly influence your Medicare supplement costs: Attained Age versus Issued Age.

Attained Age: Your rates go up as you age, but they start relatively low for all of your Medicare supplement additions when you first enroll.

These rates can quickly become very expensive.

Issued Age: Your rates never go up as you age, but you pay more initially for your premium that will stay the same during your retirement years.

Can You Afford Not To?

If you have $40,000 a year to live off of during retirement, can you really afford to spend over 20 percent of that on increasing health care costs? Income for Life is a Top Rated National® retirement planning company that can help you plan for your financial future. Whether you need help navigating the different Medicare supplement options or help addressing your investments in order to have a stable income throughout your retirement, Income for Life is here to help you!

The Income For Life experienced team are ready to help you make the right choice for your family!

Retiring is Easy, Staying Retired is Difficult. We Specialize in Keeping You Retired.